The topic of personal finance is somewhat contentious. It seems the answer to every question on the topic is ‘it depends’ and every time you think you’ve found the definitive authority on the subject, you will find a completely contrarian view with your next mouse click. So what to do? Keep it simple. Educate yourself. Get some good, objective advice. And have a plan.

Not Financial Advice

I am not a qualified financial adviser, accountant or lawyer ( #notafinancialadviser, #nafa). I do not know your personal circumstances. So this post is ‘information only’. I don’t agree with all the views shared by those I link to in this post. Whilst I strongly encourage you to get your own finances in order, I also encourage you to seek professional guidance. Tax and company law is complex, the decisions you make in this area can have significant impacts on your personal and professional life. But don’t let this discourage you, this is an area of your life where simple decisions can have a massive impact.

How to Make a Financial Plan

There are numerous ways to do this, but a sensible approach involves 5 steps:

- Work out where you are today – this involves preparing 3 financial statements – a statement of cash flow, a statement of income and expenditure, and a statement of assets and liabilities. In business, the last two reports are called a Profit and Loss Statement and a Balance Sheet.

- Work out where you want to go – clarify your short, medium and long term goals across all aspects of your life – family, professional, travel, health etc. Ray Dalio says ‘You can have anything you want, you just can’t have everything you want’. Sage advice. Identify some goals, establish some priorities.

- Work out how to get there – this involves having an understanding of the various asset classes or wealth-generating vehicles, and the basic investment strategies that support them, things like compounding interest, diversification, risk etc.

- Create a plan – select the route that delivers the results you require with an appropriate mix of investment strategies that balance risk, your investing preferences and investment capacity.

- Monitor the plan – establish a routine for monitoring progress, this may involve a monthly review of your investment balances and an annual review and rebalancing.

It is important that you do much of this work yourself, we’re talking about your goals, your life and your preferences here, but engaging the services of a professional will ensure the complexities of tax, legal compliance and changing markets are incorporated into the plan.

Resources

There are way too many people claiming to have your financial interests at heart. Just be aware, their own financial interests are most likely their first priority. And also be aware, all advisers sit on a continuum that begins with ‘the apocalypse is upon us’ and continues through to unicorns and fairy dust, ‘there has never been a better time to invest’. Be sure to seek a range of views, be aware of confirmation bias (sticking with those who agree with your existing opinions) and always fact check. For every impressive graph or statistic, there is an equally impressive counter-argument.

With these words of warning out of the way, here are some interesting places to begin, or expand, your education.

Financial Actuality

An understated but incredibly thoughtful website rich in wisdom and devoid of hype. Take your time when visiting, there are gems of wisdom throughout, don’t miss them.

Next Level Wealth

Peter Wargent and Steven Moriarty have written a book and produce a podcast called ‘Low Rates, High Returns‘. The ‘Next Level Wealth’ website has some good content and their approach to investing is a little different from the traditional ‘buy and hold’ approach popular with many more conservative financial advisers.

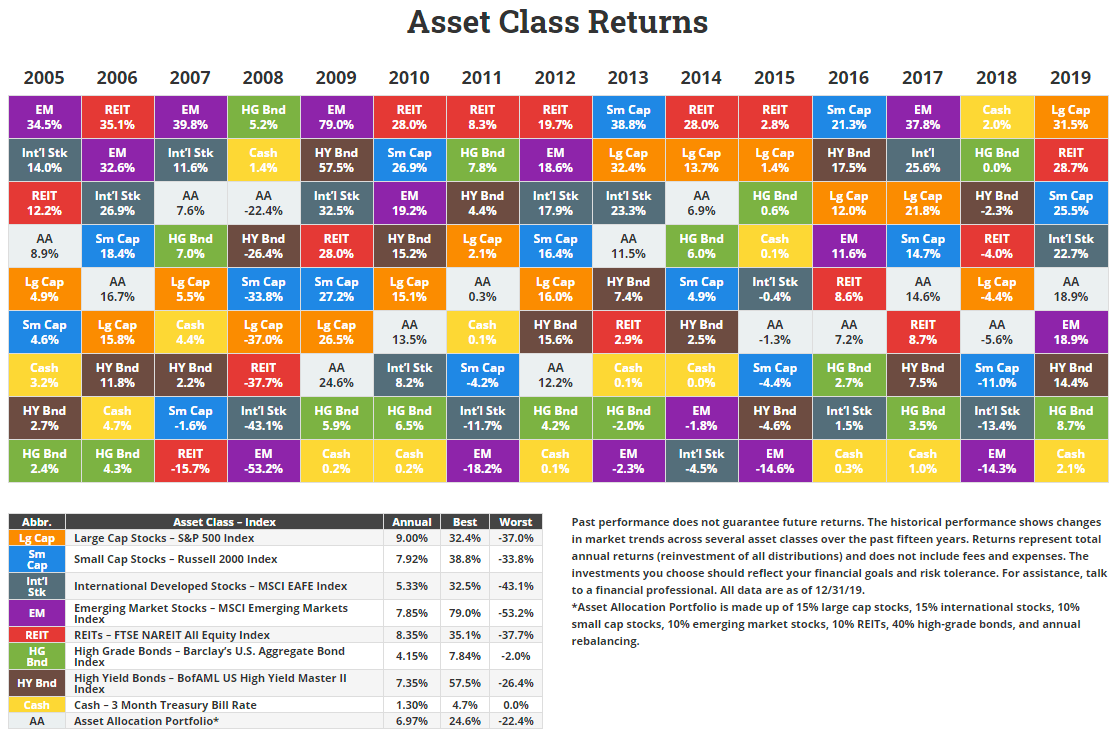

Novel Investor

Peter Wargent from Next Level Wealth introduced me to this website. It’s US-based but includes a number of very illustrative tables including the ‘Quilt of Asset Class Returns’ and several similar data tables. This is another site with some interesting commentary and some great resources.

Source: NovelInvestor.com

Source: NovelInvestor.com